Spectacular Tips About How To Apply For Lafha

To find out more about the range of allowances and scholarships.

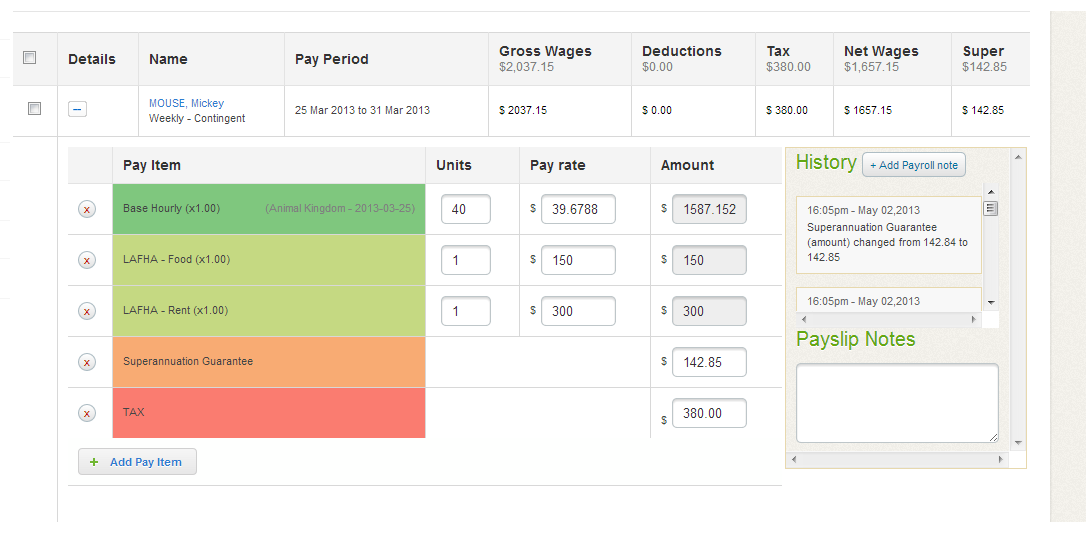

How to apply for lafha. The lafha allowance is financial support for students who live away from home. 2022 lafhas applicant guidelines keywords: Your employee maintains a home in.

The allowance is available to eligible full and part. To apply for food assistance benefits online, please visit mydhr. The family assistance division administers programs funded by the temporary assistance for needy families (tanf) block grant designed to provide benefits and services to needy families.

You can start your application online and even close online in some cases. Lafha is a commonwealth government allowance to assist young people who have to move away from home to take up or continue with an apprenticeship or traineeship. If you’re training as an apprentice and need to move away from home, you may be eligible for the living away from home allowance (lafha).

Assistance for australian apprentices with disability the australian government. Joined aug 23, 2009 · 2 posts. You will need to submit a completed application for lafha for australian apprentices form to your local australian apprenticeship support network (aasn) provider.

2022 lafhas applicant guidelines author: Eligibility is based on family income, distance from a secondary school, other circumstances are taken into. To see if you are eligible for to apply for the lafha contact your local apprenticeship network provider.

At the time of your appointment, you will need your completed pre. Yesterday the australian government treasury released exposure draft legislation for the changes to the taxation of living away from home allowance. Information for applying for food assistance benefits online.