Unbelievable Info About How To Build A Balanced Portfolio

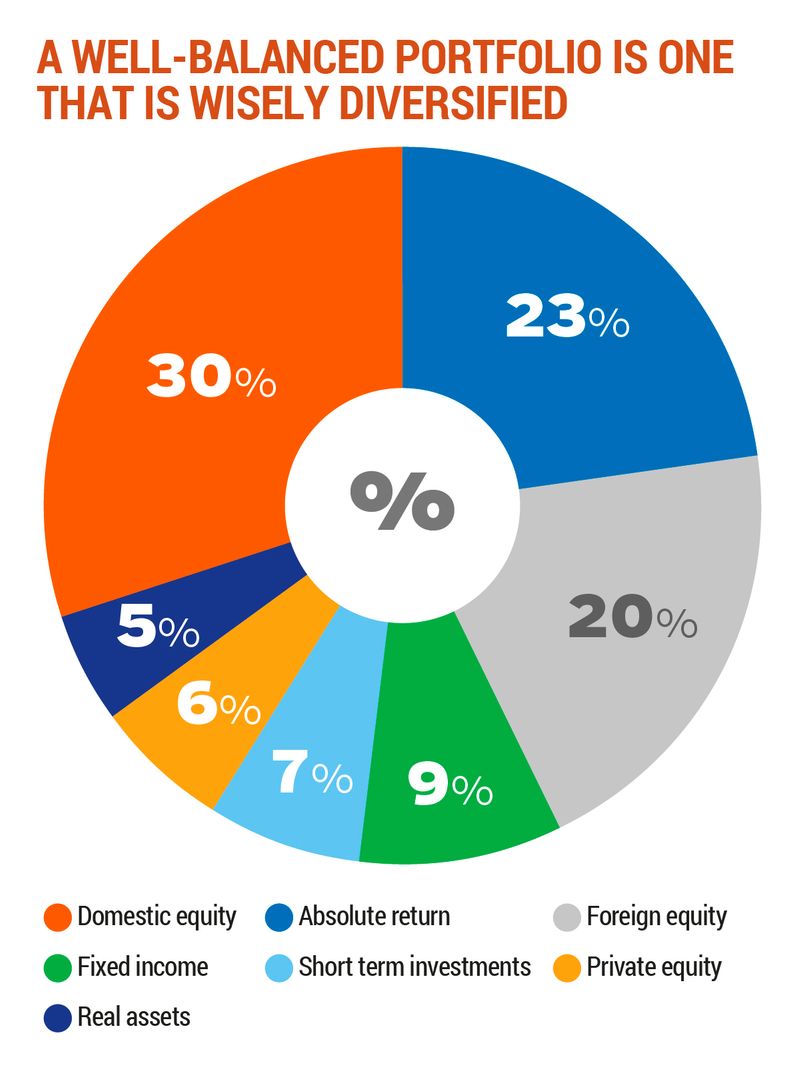

The number one rule of making a balanced crypto portfolio is diversification.

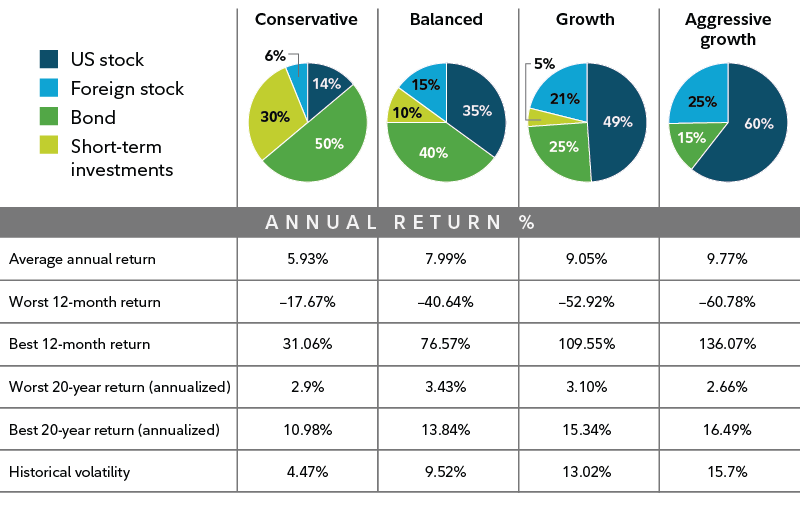

How to build a balanced portfolio. Divide the investments in your portfolio by risk levels: Combining different types of mutual funds creates a balanced portfolio. Decide what you want to achieve.

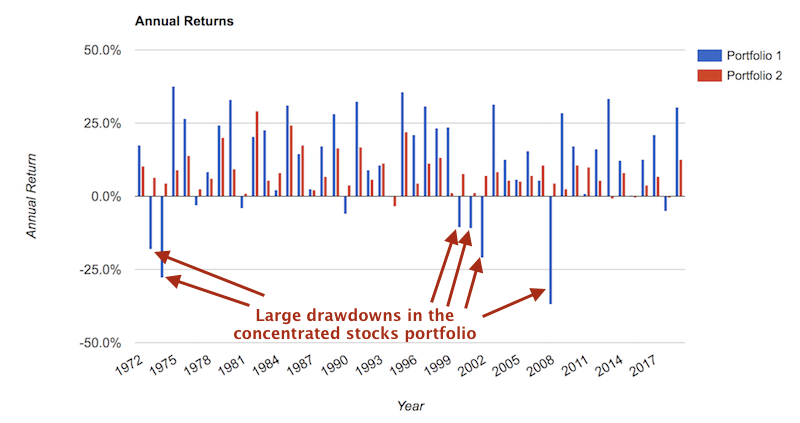

The creation of a properly balanced investment portfolio starts with generally accepted levels of diversification and is adjusted to the unique risk tolerance and financial. To make your job easier, below are some tips for you on creating a balanced portfolio: Make sure to have assets in your portfolio that have both high and low risks associated with them.

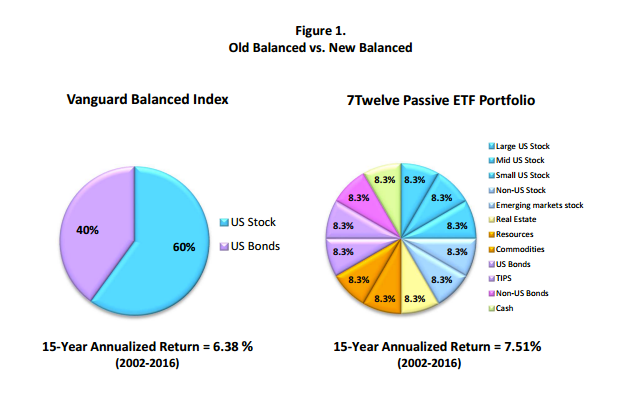

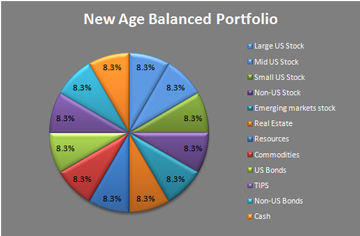

Setting and achieving goals is a key part of successful crypto investing. The even split between stocks and bonds is something that a balanced portfolio strives for on an ongoing basis. However, there are general rules to follow:

Just sign up to an exchange and purchase your first bitcoin (btc) or ethereum (eth). One core fund can serve as the foundation, with funds in various categories making up the rest. The simplest option is to park the funds into savings such as a money market account.

Just like with the traditional markets, the process of choosing each coin for your crypto portfolio might take some time, because for every coin, you will have to conduct a technical and. If you are interested in generating income, consider building a laddered certificate of. One of the simplest ways to build a balanced, diversified portfolio is by buying index funds (baskets of holdings that match specific market indices, like the s&p 500).

An essential aspect of building a balanced portfolio is diversifying your investment assets across types, geographies, and industries. A balanced portfolio wouldn’t subscribe to either of these ideas, but instead, split the money across a group of investments across all risk categories. The split ensures that risk.

/FourStepstoBuildingaProfitablePortfolio-171c087dc41f40269547e95a0b60eab5.png)

/building-complete-financial-portfolio-357968-color-FINAL2-86933638b6844aa296049011de61d7fb.png)