Fun Info About How To Buy Resale Flat

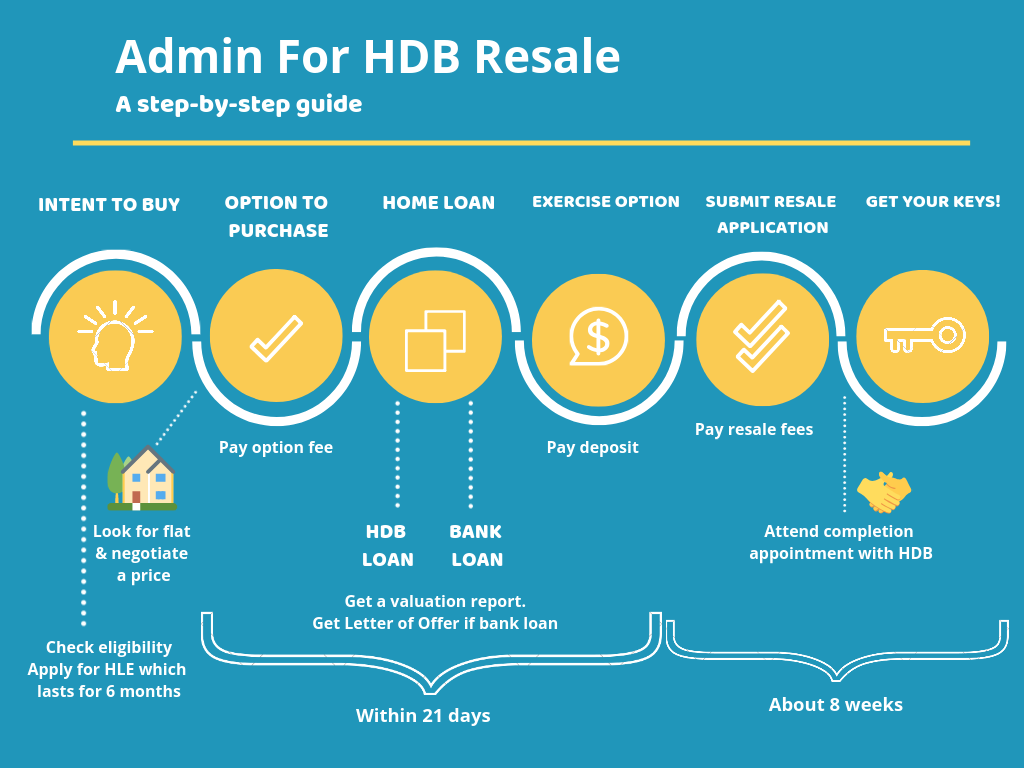

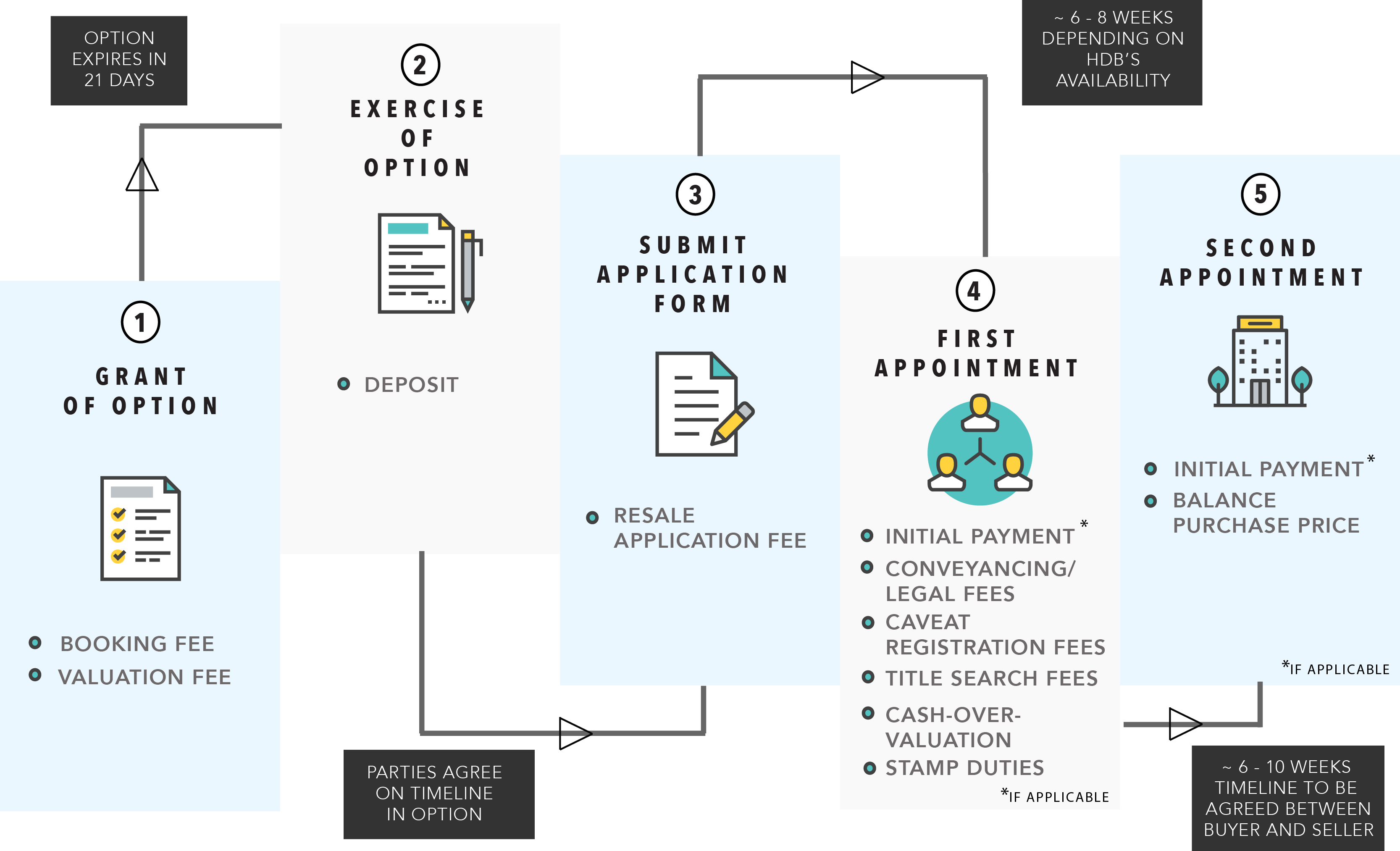

This fee amounts up to $5,000 and is paid in 2 stages:

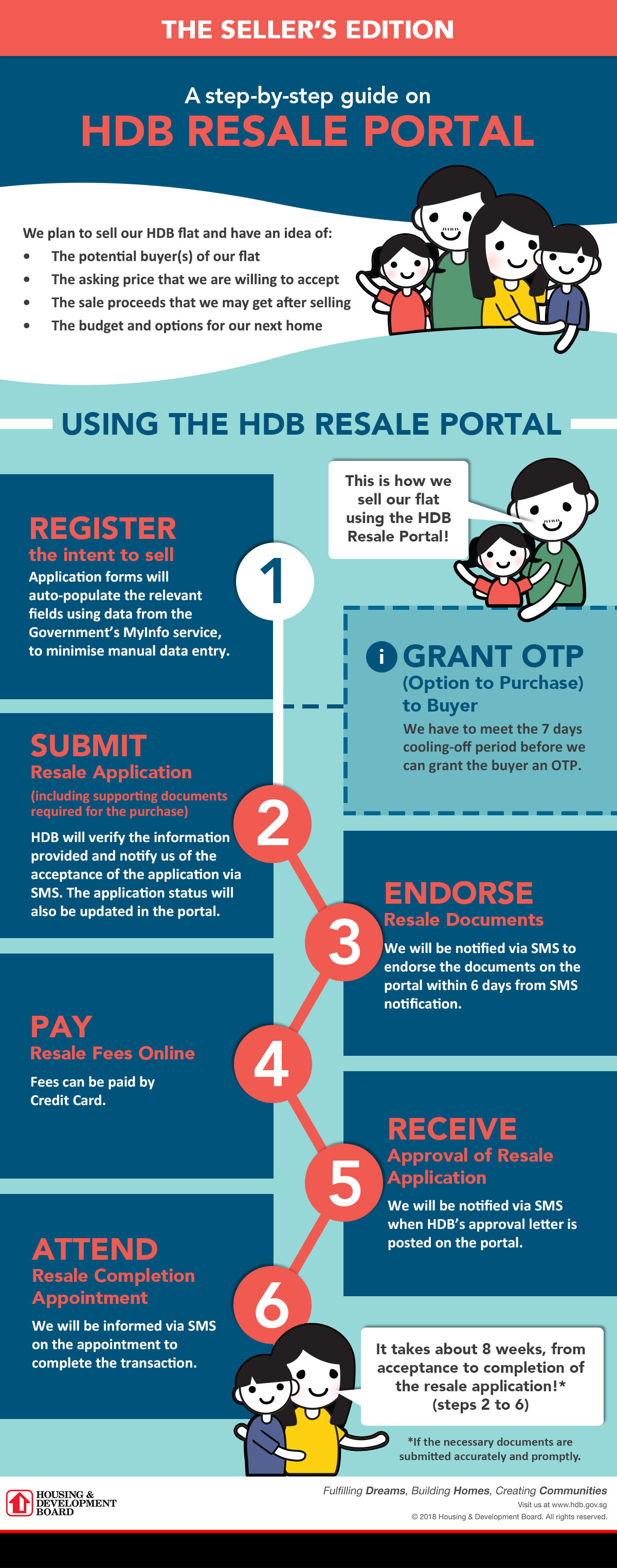

How to buy resale flat. Buying an hdb resale flat is a significant financial commitment. Conveyancing fee for hdb (up to 1000 sgd) 2. If you are buying a house in mumbai that will be ready for possession, say, in two years, you will pay 2% as stamp duty and 1% as the registration charge on the purchase.

This increase in cost is usually because there may be. Just like an astute auntie at a sale, this list will tell you if the resale flat you’re looking at is treasure. Once you have received an otp, you have 21 days to.

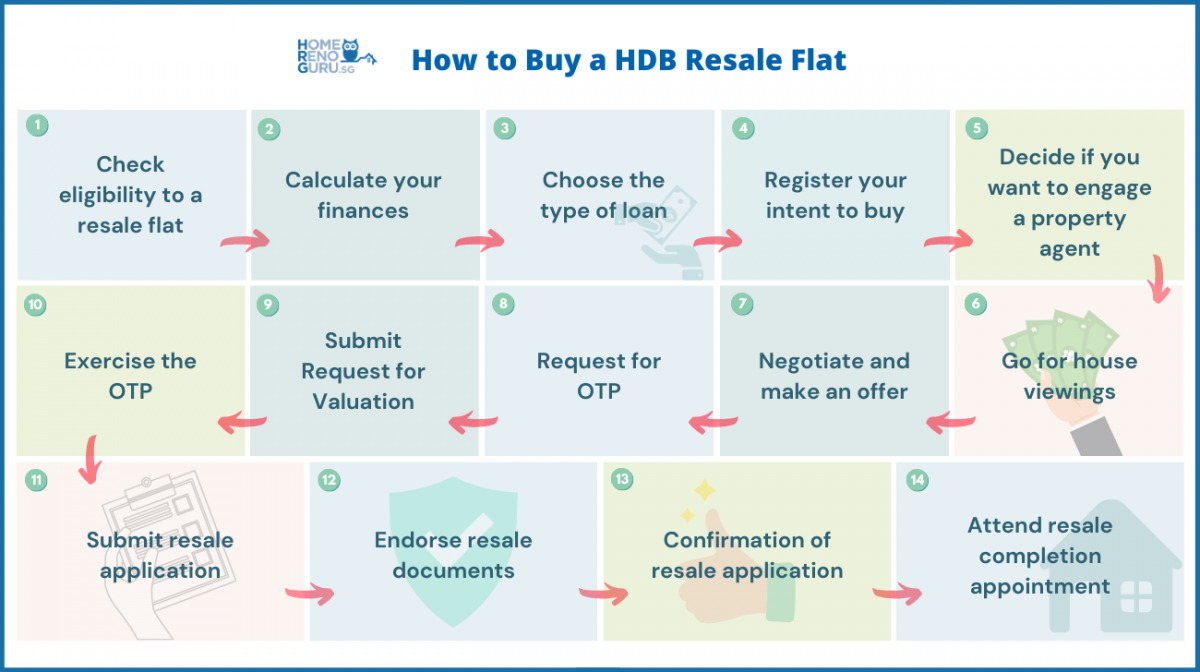

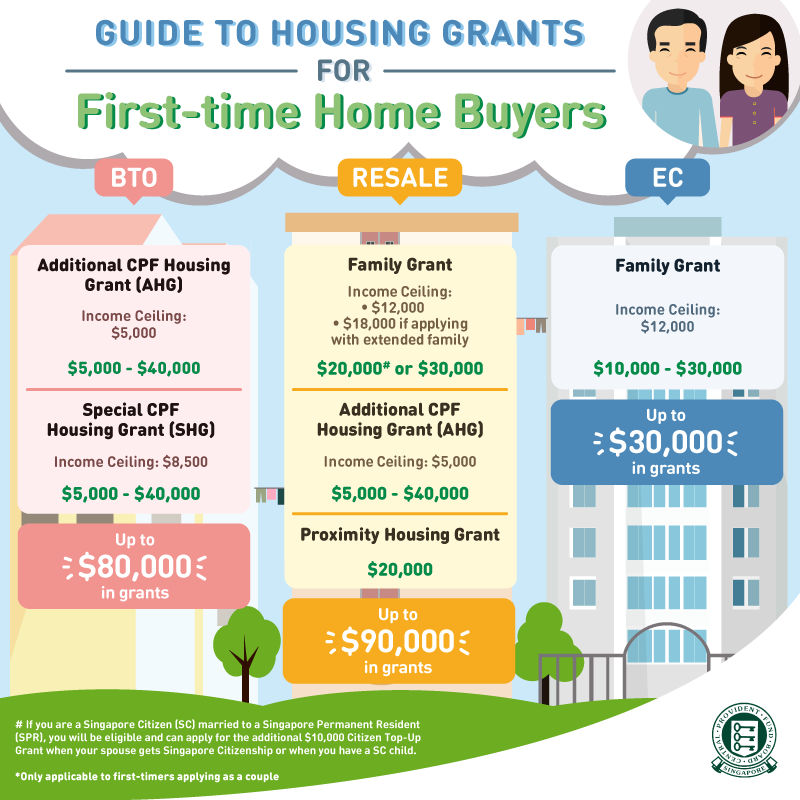

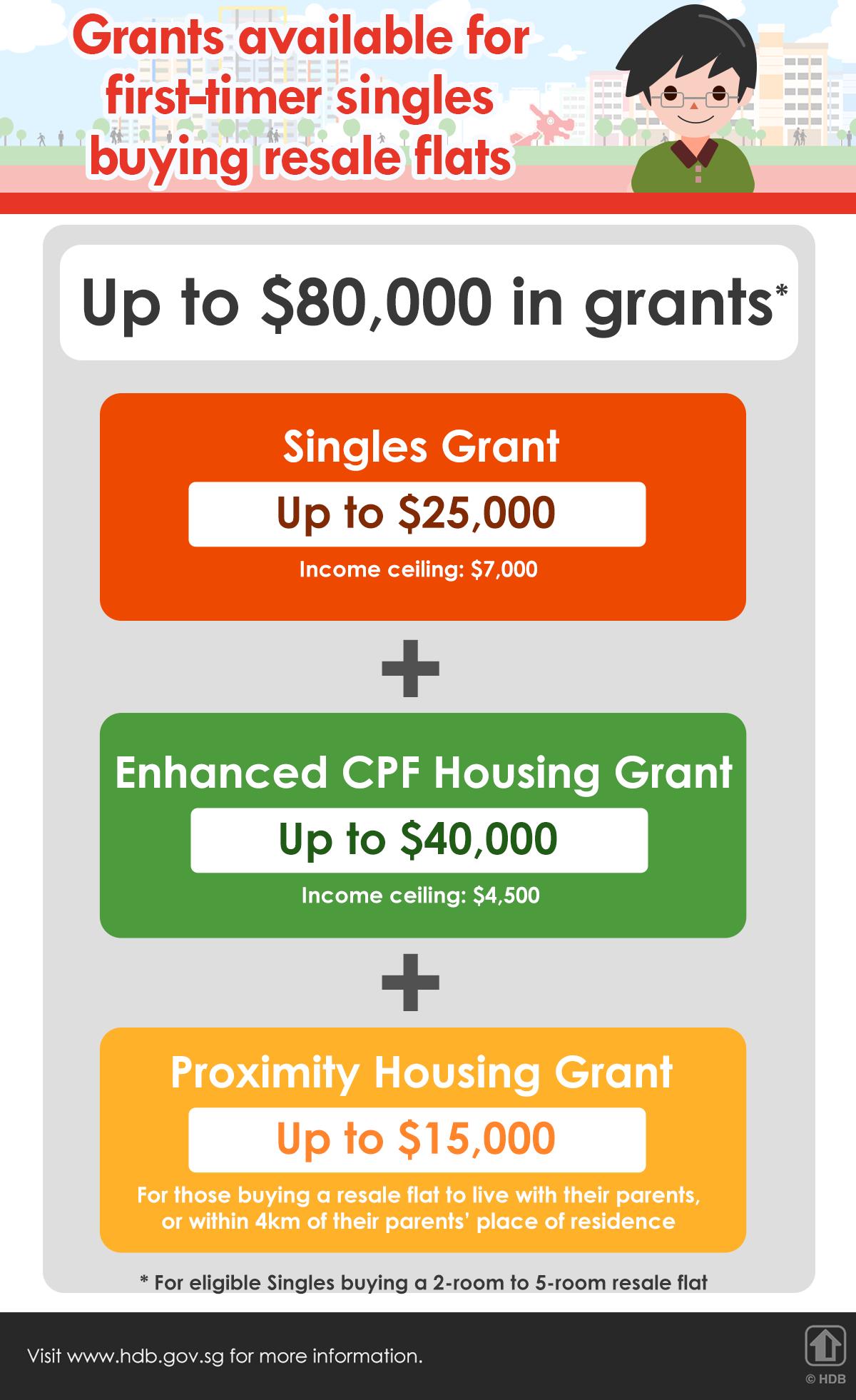

Check title of a resale flat/ property 3. To check your eligibility to buy a resale flat, register your intent to buy through. Singaporean singles who want to buy an hdb resale flat (you’ll need to be 35 years.

Before you start the process, first check if you are eligible to purchase. Buyer’s stamp duty (bsd) 2. Yes, you can apply for a home loan to buy a resale flat.

You can check propertyguru’s hdb resale listings. Can i apply for a home loan to buy a resale flat? If you want to buy a resale flat with your fiancé/ fiancée single singaporean citizen scheme:

The council for estate agencies (cea) has a. Check required documents for buying a resale flat/ property. Choose between an hdb loan or bank loan, each with different t&cs.