Wonderful Tips About How To Check If Your Bank Is Fdic

/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9-cbf2392d68a44e7484e66859449cc47c.jpg)

You do know once your caught forging checks, the bank or retail location you screwed over will come after you for that money.

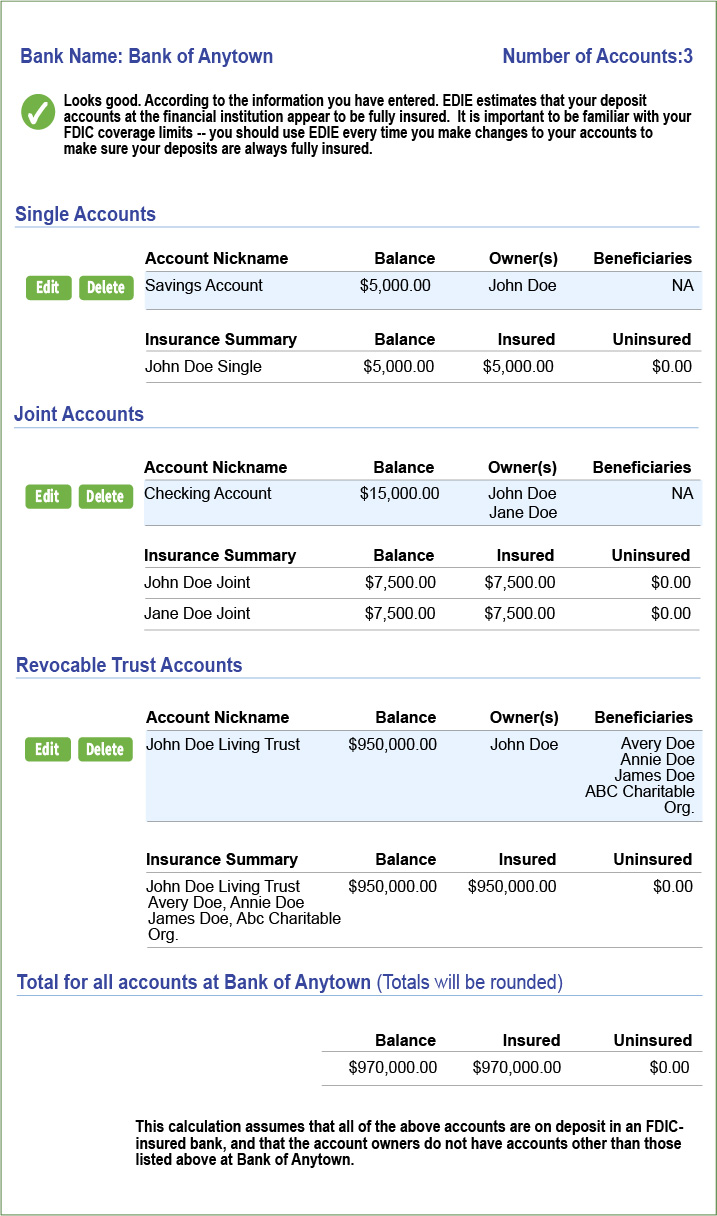

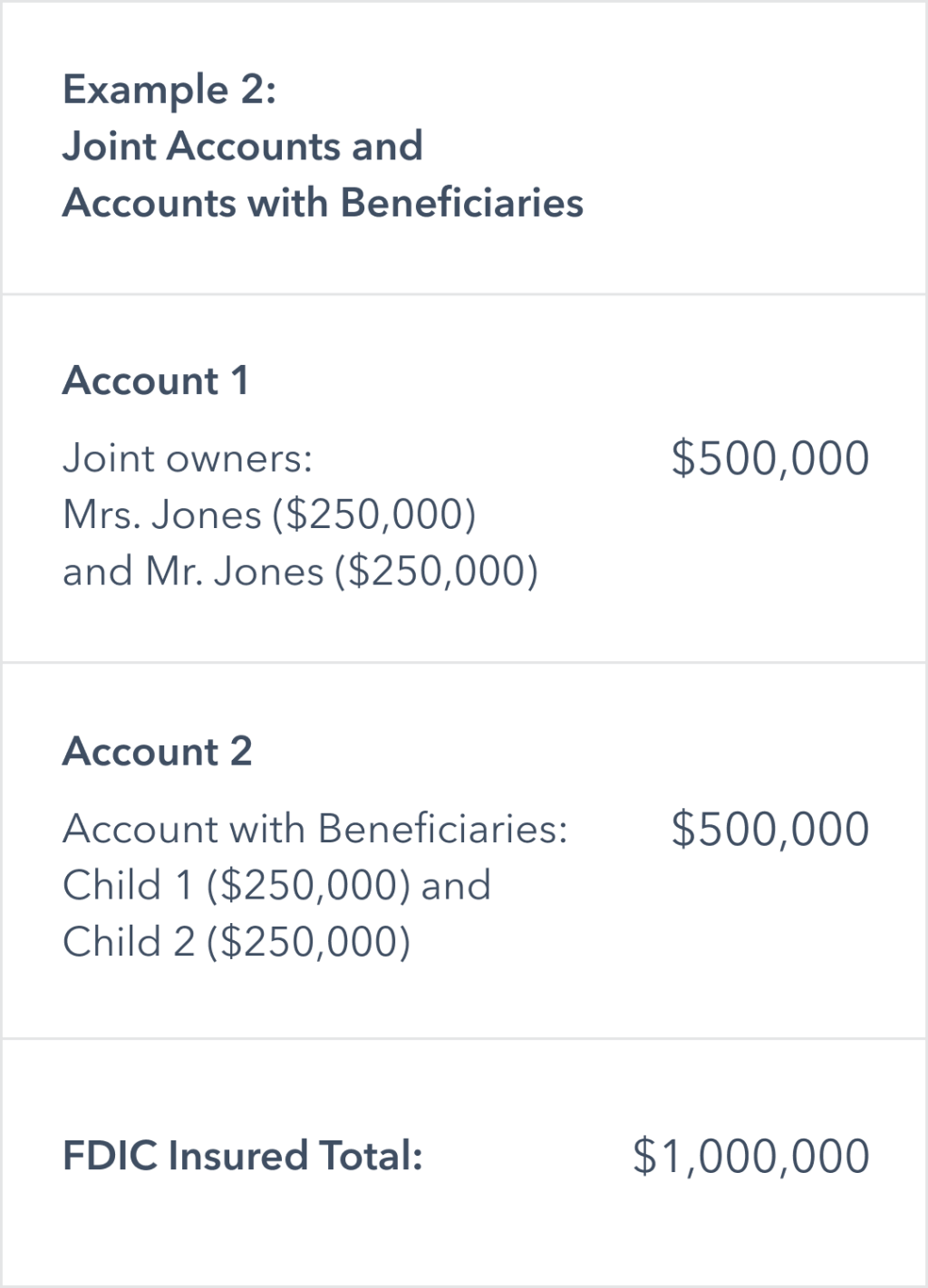

How to check if your bank is fdic. The purpose for collecting this information is to. You can deposit a check into your bank account by taking a photo of the front and back of the check and submitting it through your. If you deposit $1 million in.

(if you haven’t done so yet, first enroll in associated bank digital.) tap “deposit a check.”. Find out if your bank has merged or been acquired; Second, make sure your deposit accounts don’t exceed the $250,000 limit per depositor, per.

If the bank is not open anymore and failed within the last 18 months,. The federal deposit insurance act (12 u.s.c. (fdic) is the agency that insures deposits at member banks in case of a bank failure.

You receive an overpayment for an item you’re selling,. Always look for the fdic logo on a bank’s website, but you may want to look in the fdic directory to make sure your bank is listed. Here’s how it’s usually done:

Let's take a look to see if this is an option. The federal deposit insurance corp. Funded by the financial services industry, fscs is an independent and free service, protecting you when financial firms fail.

It can’t bounce because whoever bought one had to have the money in their account or give the. A quick way to find out if your deposits are insured is to search for your bank on the fdic’s bankfind tool. Find out a bank's texas ratio.

/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)

:max_bytes(150000):strip_icc()/fdic-history_V1-5912fcf474b04c5891e185fd3145f6d0.jpg)