Great Info About How To Find Out My Adjusted Gross Income

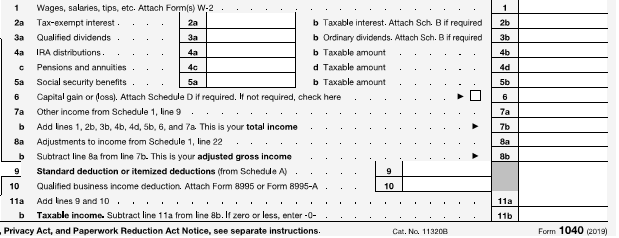

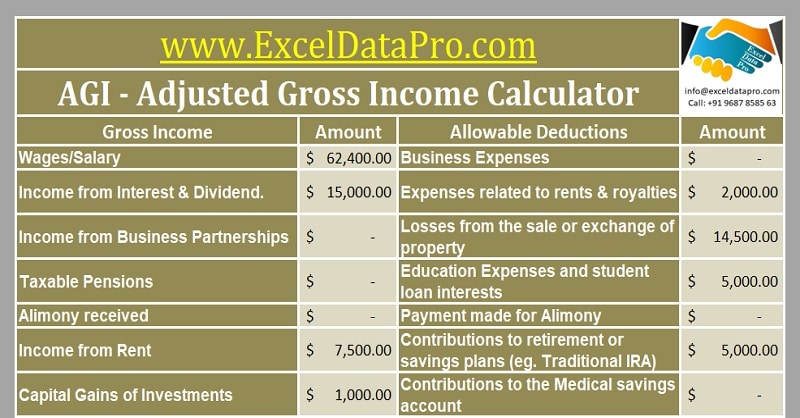

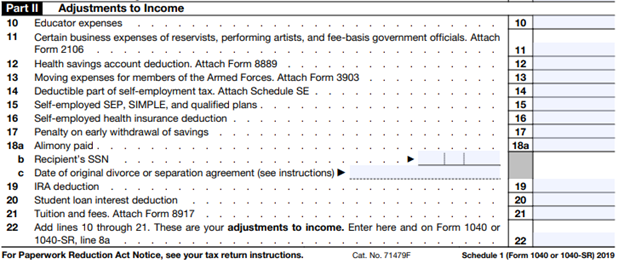

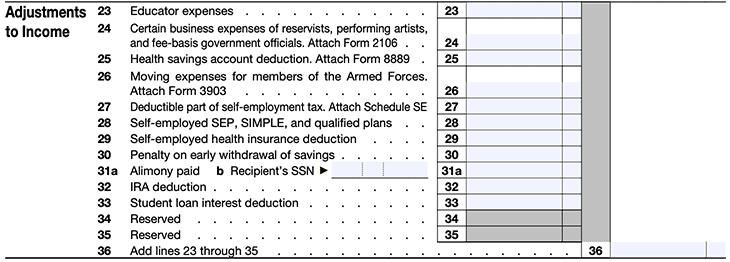

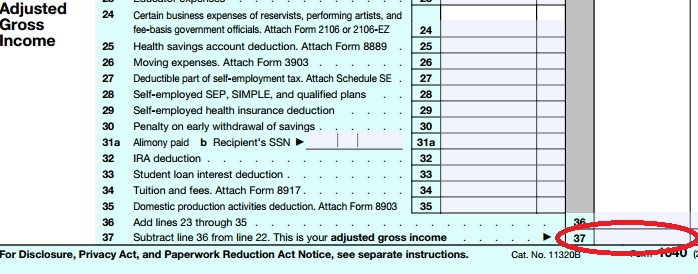

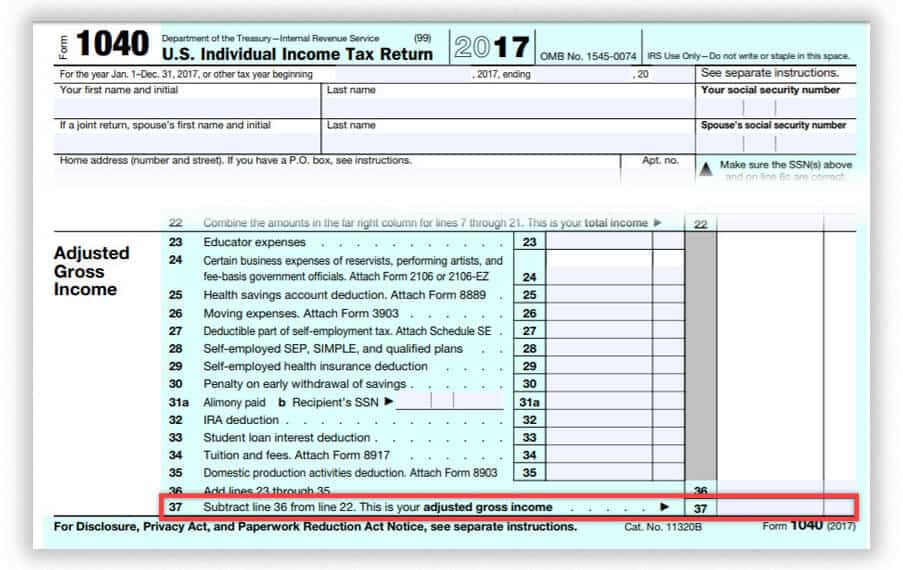

Adjusted gross income is your gross income minus certain adjustments to income.

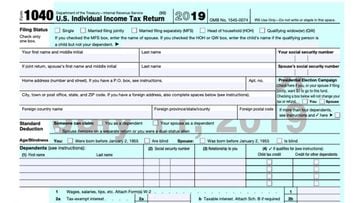

How to find out my adjusted gross income. For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively. Select view adjusted gross income (agi) if you've already filed your 2021 tax return, you must select 2020 first; You won't find your modified adjusted gross income on your tax return, but it is easy to figure out on your own.

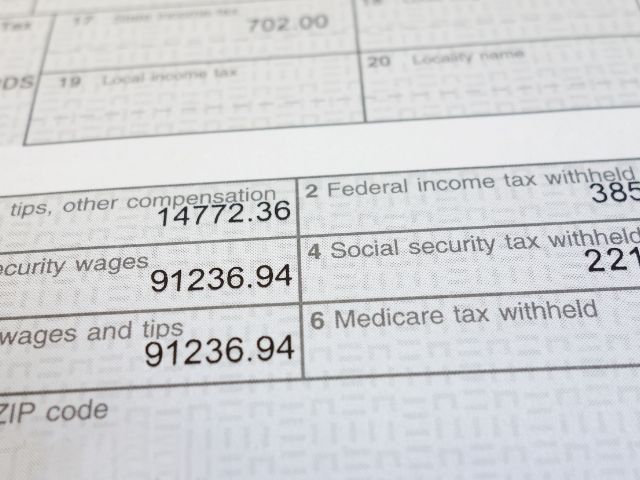

How to work out your adjusted net income. Your adjusted gross income is your gross income on your w2 minus your major deductions for the year. Follow these steps to quickly determine your agi:

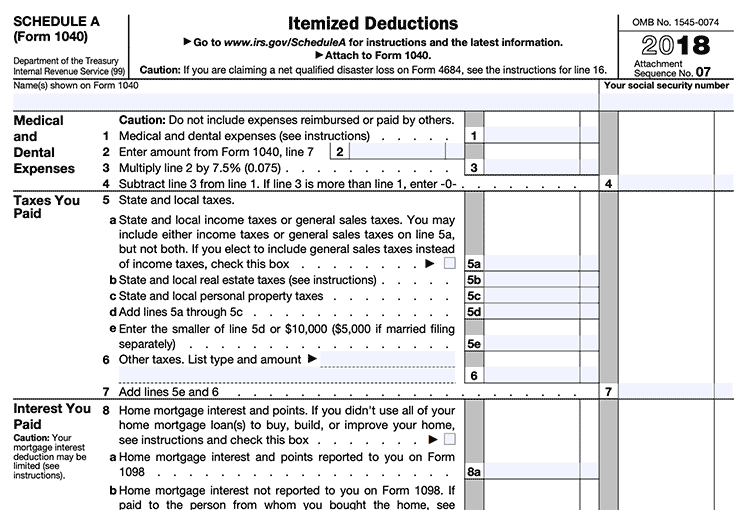

Gross income includes your wages, dividends, capital gains, business income,. Examples of expenses that can be deducted include: Agi helps determine how much tax you owe and what credits and deductions you.

Adjusted gross income (agi) is defined as gross income minus adjustments to income. You then find that your adjusted gross income is $59,300 after subtracting the $3,200 in total adjustments to income. How to calculate adjusted gross income 1.

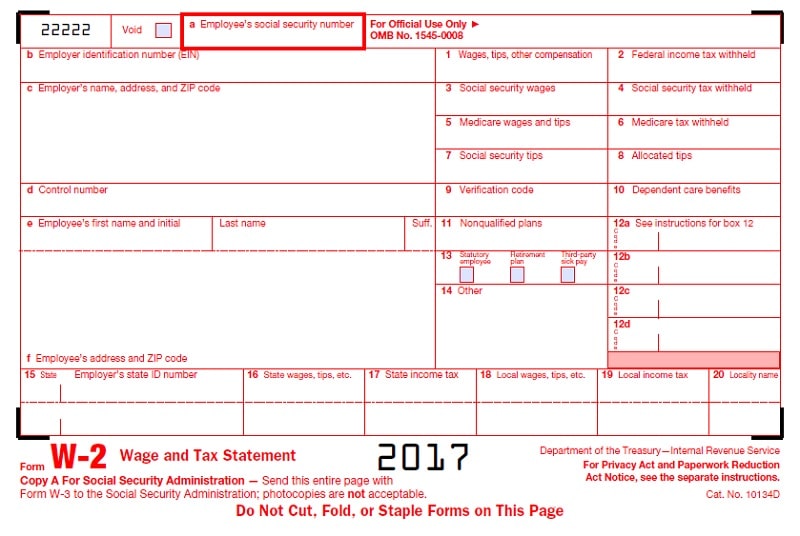

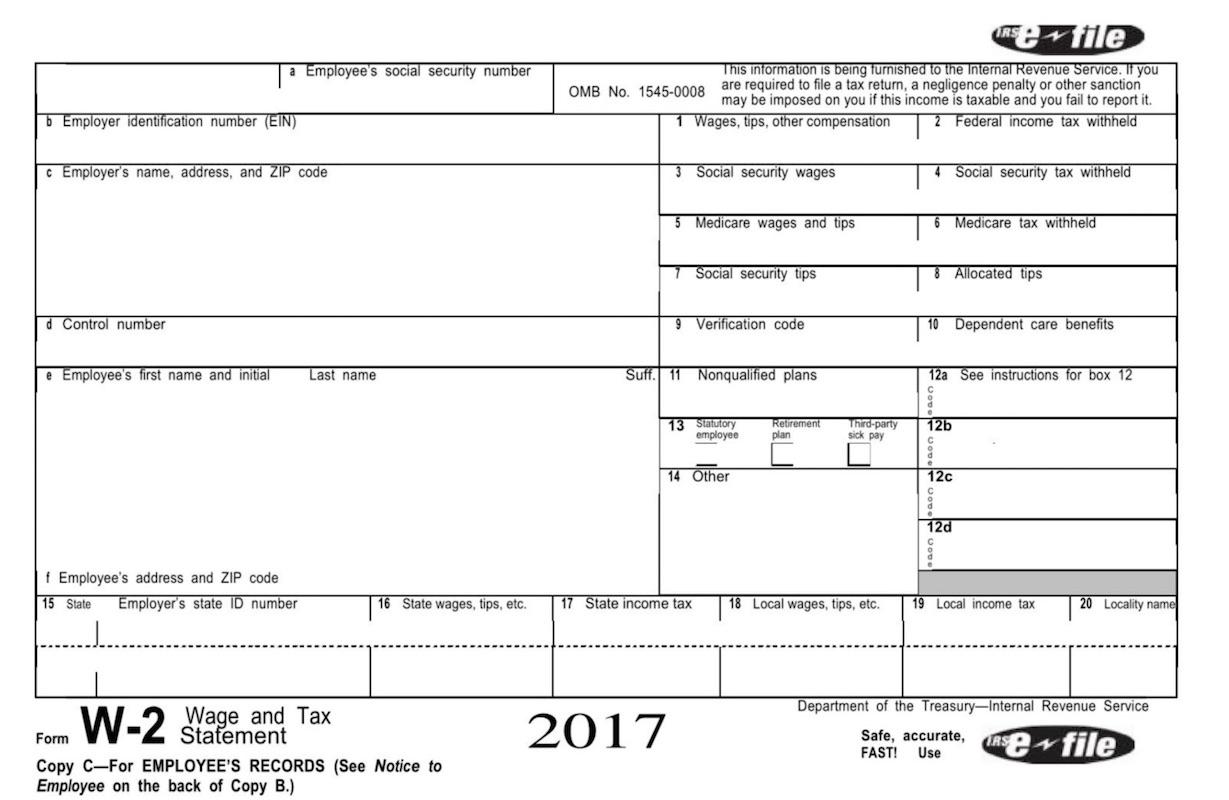

The agi calculation is relatively straightforward. Determine your gross income at the beginning of tax season, your employer will provide a w2 with your gross income,. Every tax return form has a line to report it.

I didn't file my 2020 taxes with turbotax and/or i don't have. Did you file your taxes last year? You can calculate your agi for the year using the following formula:

/GettyImages-904286032-4cc94e81854841989b260d5df5ae98d6.jpg)