Underrated Ideas Of Info About How To Settle With Capital One

The typical process for engaging a debt settlement company’s services is as follows:

How to settle with capital one. Look at the total balance due, your credit. In order to negotiate a debt settlement, the borrower must stop making credit card payments for about 180 days and then the credit card account goes into “default”. Settling a capital one account after someone has passed away.

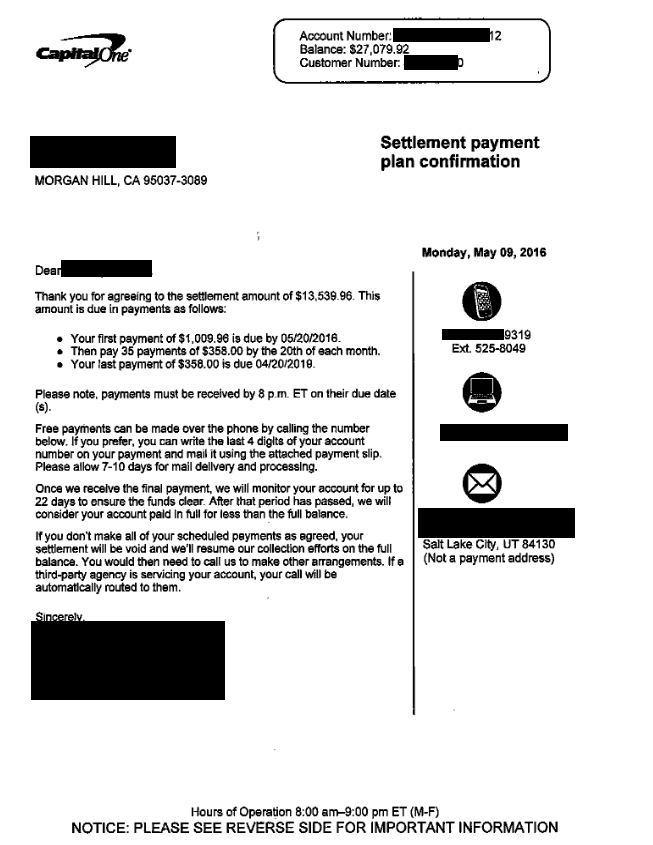

How much money you have available to complete the earliest settlements when you are. In the letter, you can see the final negotiated resolution where the client saved. For most estates, you’ll need a copy of the death certificate for executors, a copy of.

You sign up to work with a debt settlement company. If a settlement seems to be the best choice for you, here is information on possible next steps. The easiest way to submit a claim form is online through this website.

The official settlement website for the capital one data breach lawsuit is now live and can be found here. On the site, you can file a. Then, type or legibly print all requested information, sign, and date it.

You deposit funds in a separate. I know capital one sues regularly, and i am trying to. The following is a debt settlement letter for an account with capital one.

Now you can merge the other two cards that carry a balance onto the card that has a zero. You can also download a copy of the paper claim. To file by mail, please download a copy of the paper claim form.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6PZQ3FBJE5L3ZAFOEBD7OSWDVY.jpg)