Nice Tips About How To Buy Cmbs

Purchase of defaulted cmbs loans & discounted cmbs loan pay offs:

How to buy cmbs. Cmbs loans are offered by conduit lenders as well as many banks. They use a bank to get a mortgage that lets them buy the property. A real estate investor or business owner buys a commercial piece of property.

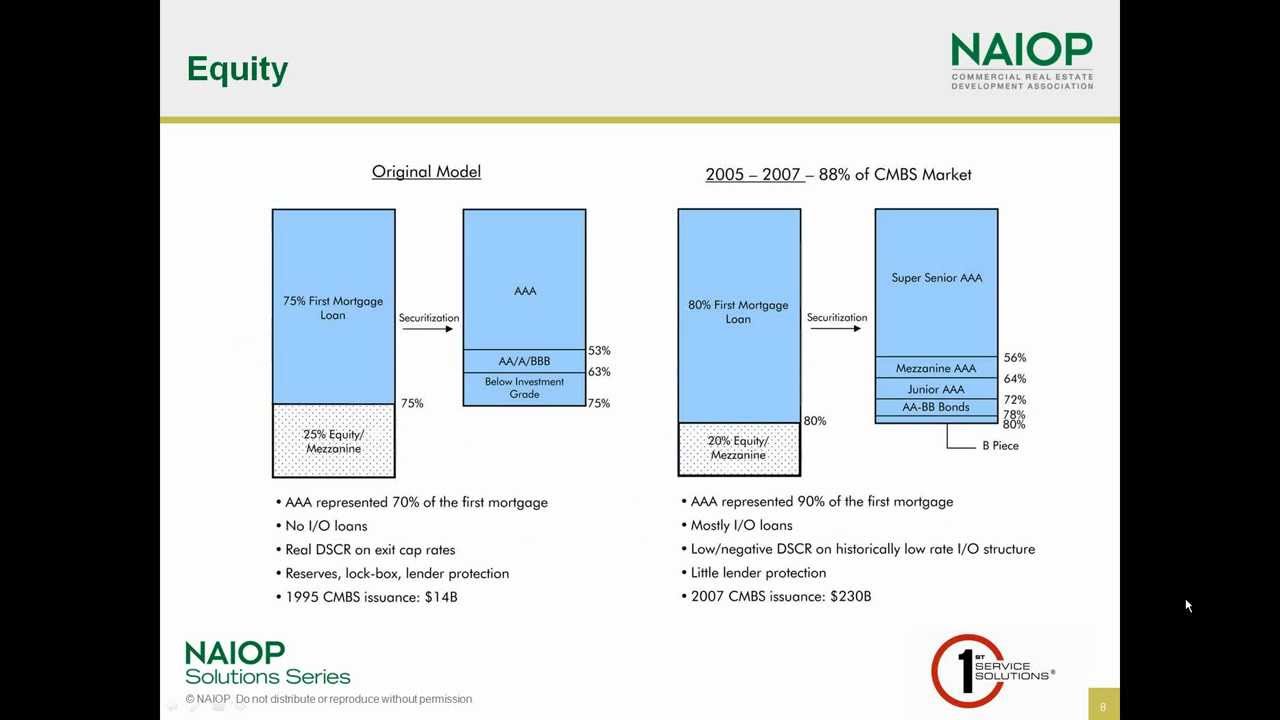

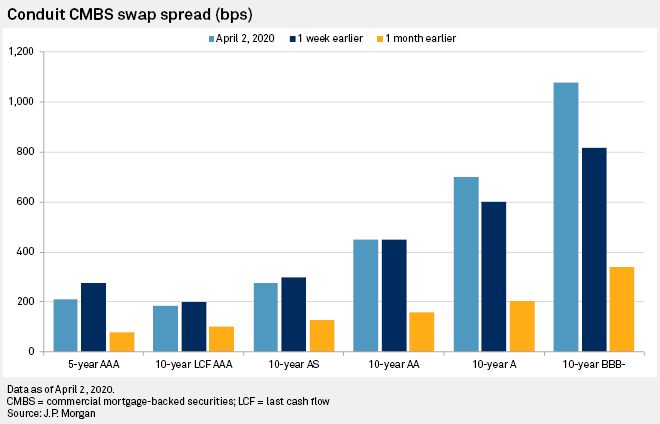

The bank pools that mortgage. The maturity on a cmb can range from a few days to six months. Cmbs loans come with fixed interest rates, which are generally based on the swap rate plus a spread, or the lender’s profit.

Net assets of fund as of aug 10, 2022 $669,454,890. Cmbs loans have some very, very unique qualities that come into play when a buyer. Conduit lenders are the providers of cmbs loans.

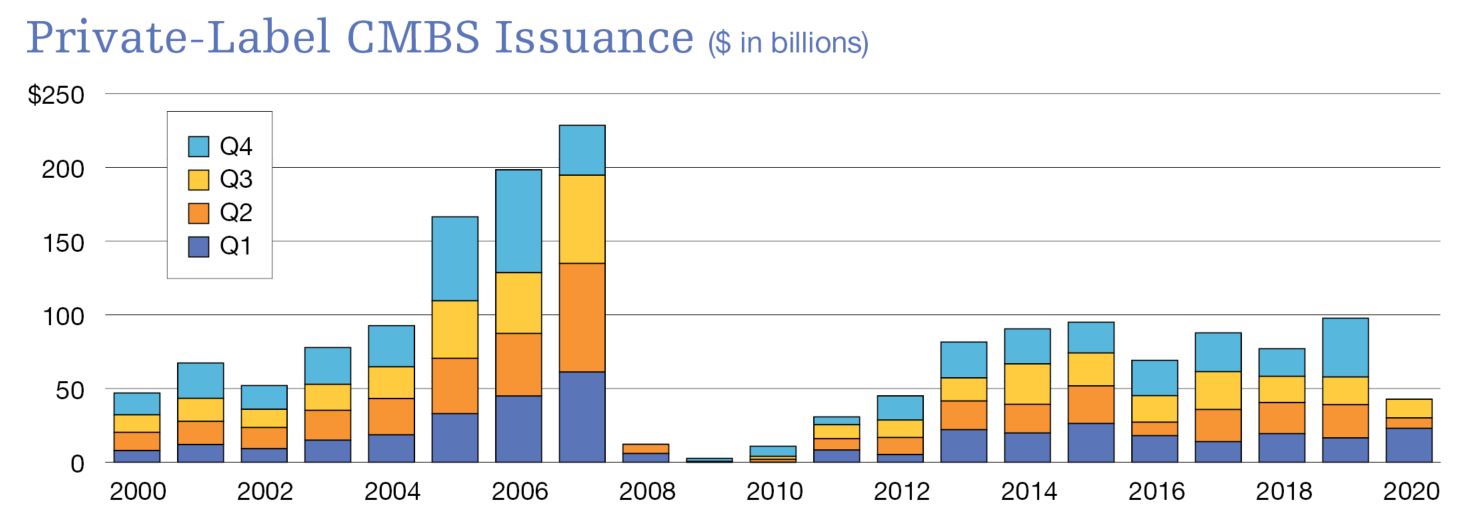

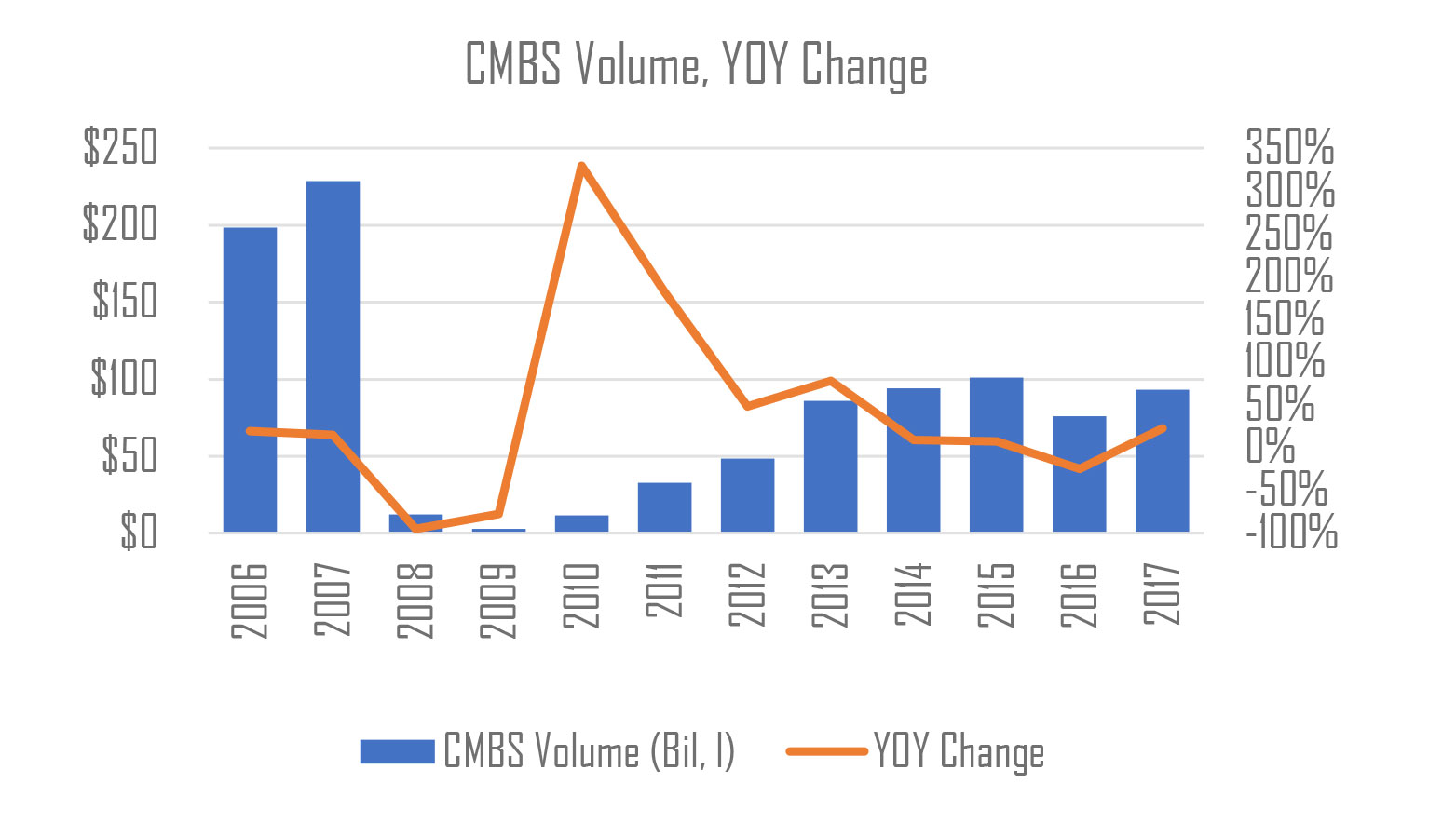

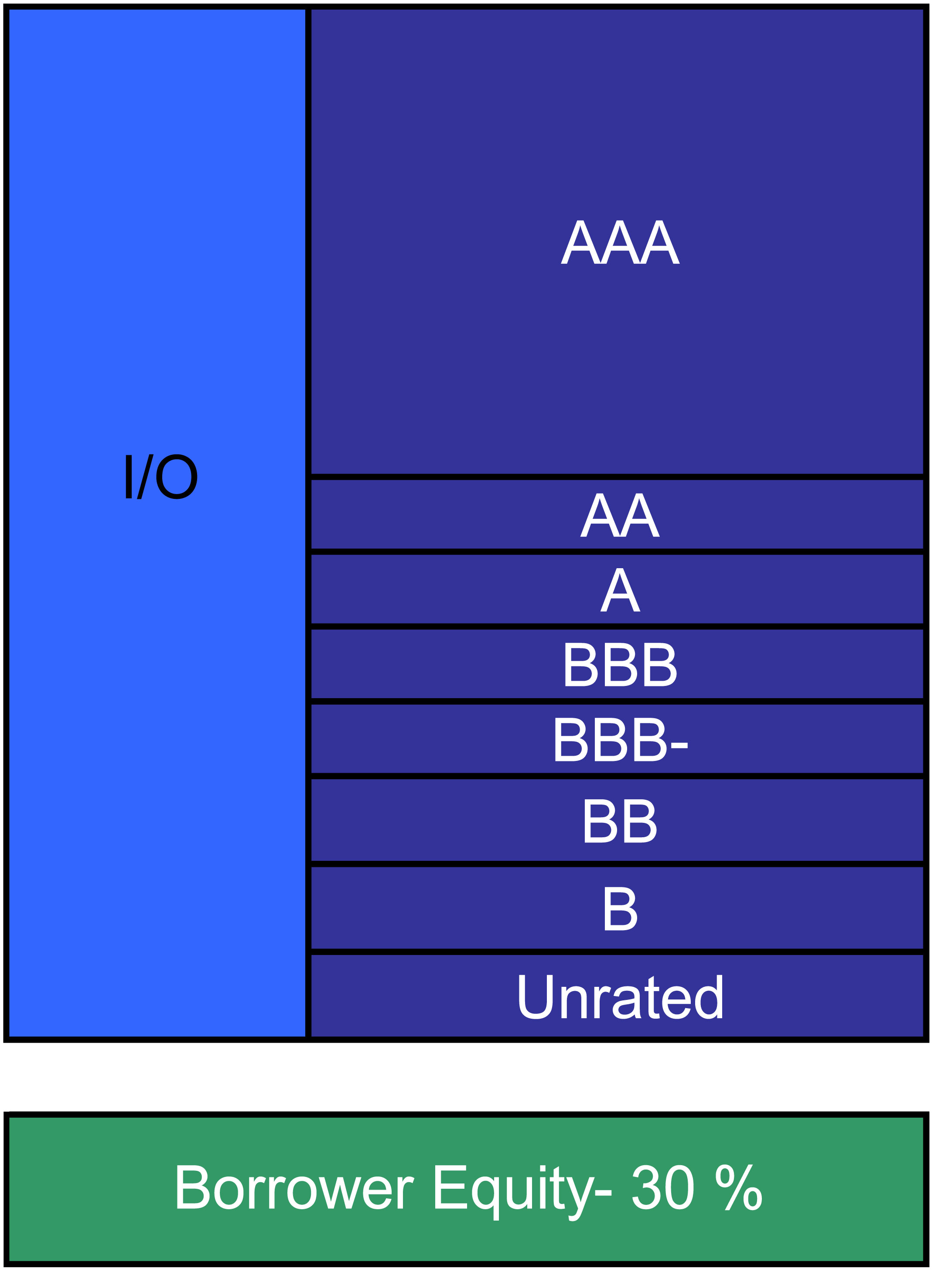

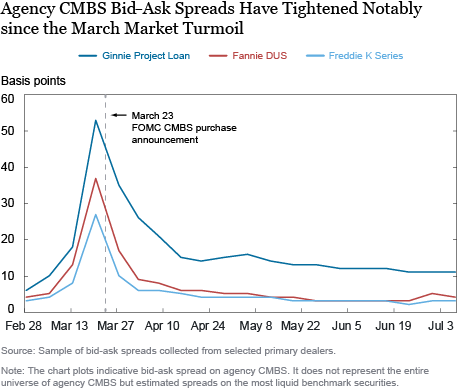

To qualify for a cmbs loan, most lenders require that you have a net worth. In today’s commercial real estate market, commercial loans are often pooled together to create commercial mortgage backed securities (cmbs). However, my concern is that with risk retention, the cmbs space is going to structurally change where there will be severe contraction, and it wont be as impactful as it.

Cmbx provides insight into the performance of the cmbs market. How to take out a cmbs loan.