Peerless Info About How To Get A Second Mortgage

The specialists we work with will compare second charge mortgage loans and quote you the most competitive.

How to get a second mortgage. Veterans united makes it easy to see if you’re eligible to buy another home with $0 down. The amount of equity you have in your home plays a major role in how much a lender will allow you to borrow with a second mortgage. Connect with a real estate agent or a home builder.

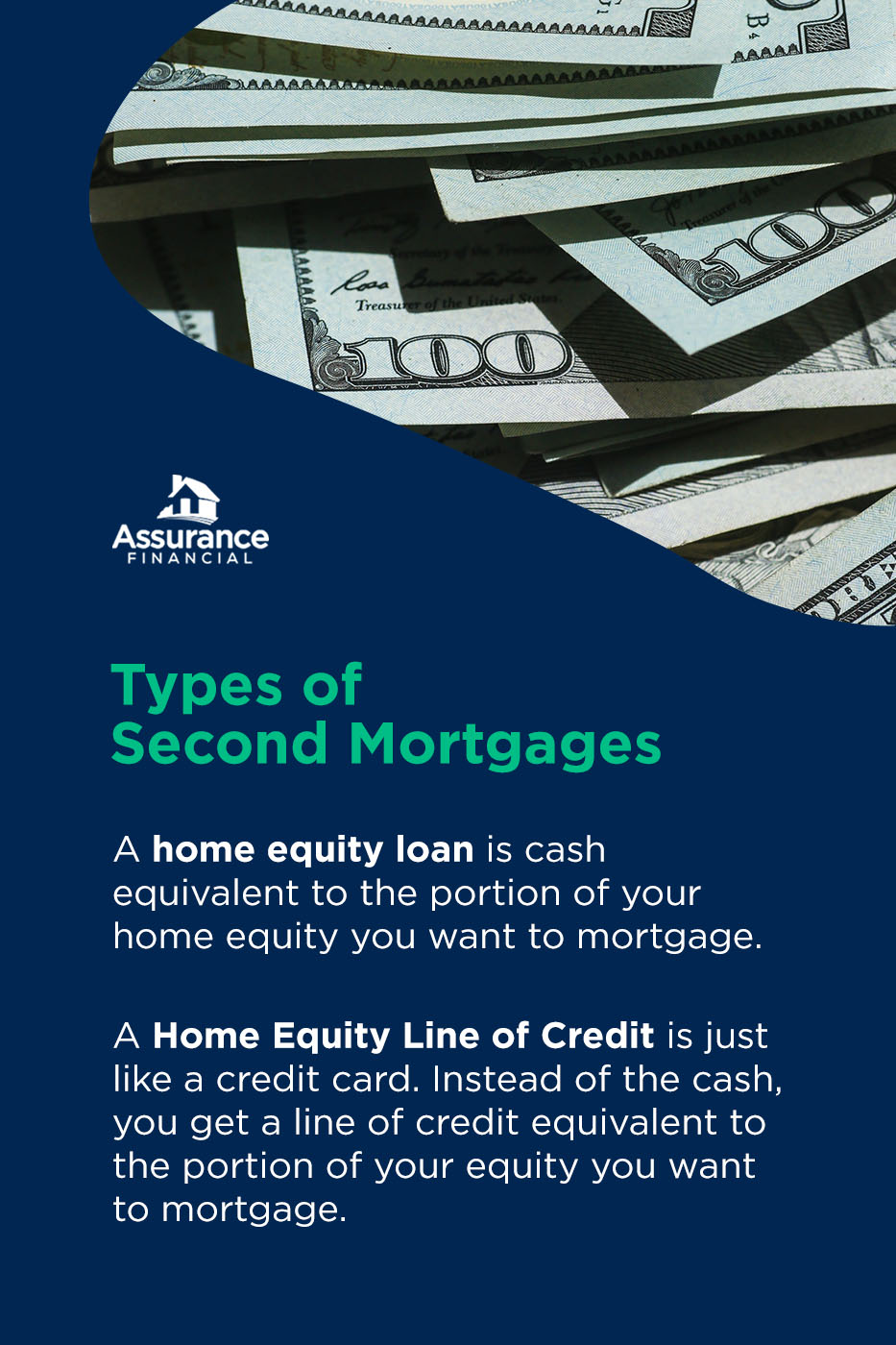

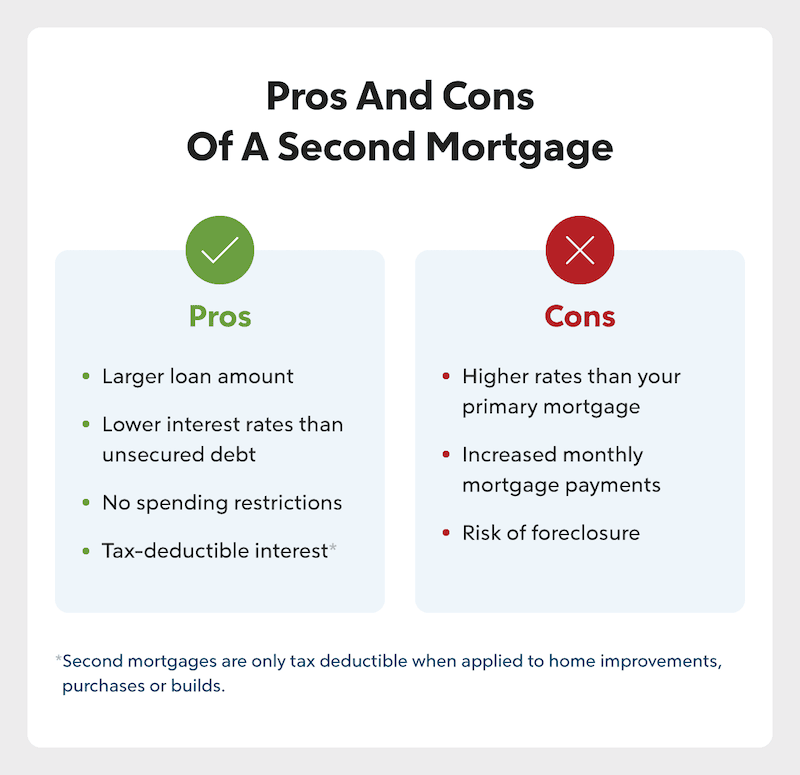

Second mortgages come in two different flavors: For a second home purchase, lenders may require a down payment of at least 10% or more. Most lenders require applicants to have a fico score of at least 680 to qualify for a second mortgage, compared to 620 for a primary mortgage.

A local bank or credit union. First, estimate how much your home is worth. The process of getting a mortgage for a second home is not dissimilar to getting a first residential mortgage.

A second mortgage is a loan secured by a property in addition to the primary mortgage. How to get a second mortgage shop around, and get quotes from at least three different sources. Second mortgage interest rates are not the same across the board.

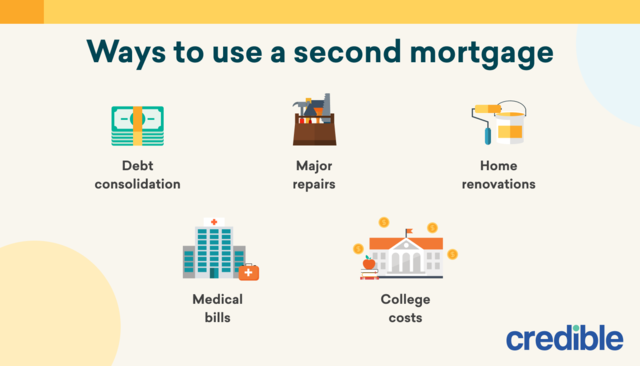

Reduce your spending and cut back on subscriptions and other bills well before applying prepare proof that your income can cover. However, some also use second mortgages to pay off credit cards and other debt. Use our comparison site & find out which lender suits you the best.

Ad nerdwallet reviewed refinance lenders to help you find the right one for you. After finding a profitable rental property for sale, the final step is to make an offer and. To determine the amount of equity you.

/GettyImages-1145828900-57f4abfc7bb343379e15f4c3fc2fce5f.jpg)

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)